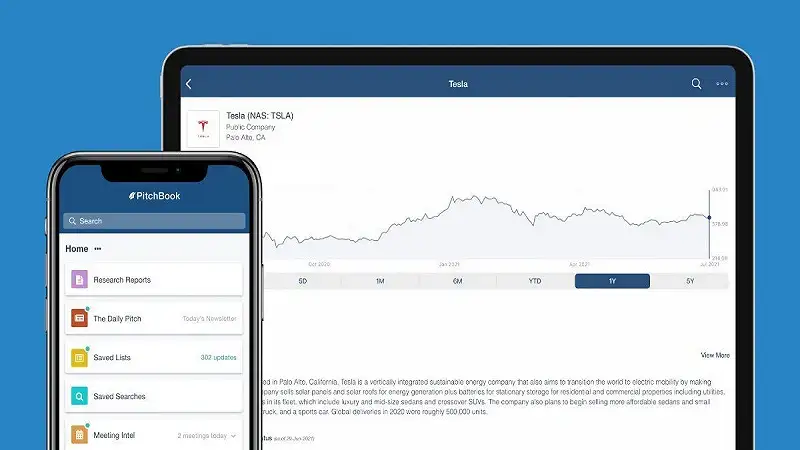

The venture capital (VC) industry has always been an ever-evolving ecosystem, where innovation, risk, and reward converge. In recent years, PitchBook has emerged as one of the most authoritative platforms for tracking VC activities, funding rounds, and market shifts. A term that is gaining attention in financial and startup circles is “PitchBook VCs 108Bpost”, which refers to the collective scale, impact, and post-investment influence of venture capitalists who collectively managed or deployed more than $108 billion in investments.

This figure is not merely a number—it symbolizes the strength of global venture markets, the rise of startups as economic engines, and the transformation of traditional funding into a more dynamic, tech-enabled process. To fully grasp its significance, we need to break down what PitchBook VCs 108Bpost means, how it shapes industries, and what its long-term impact may look like.

What Does PitchBook VCs 108Bpost Mean?

PitchBook, a renowned financial data provider, tracks investment trends across private equity, venture capital, and M&A activities. The term “VCs 108Bpost” refers to the post-investment valuation and impact of venture capital firms that collectively represent over $108 billion in funding commitments.

-

PitchBook provides the data, analysis, and insights.

-

VCs (venture capitalists) represent the firms and investors backing startups.

-

108B indicates the financial scale—$108 billion in managed funds, investments, or post-money valuations.

-

Post refers to the post-investment phase where companies start scaling, generating returns, and impacting their respective industries.

In essence, PitchBook VCs 108Bpost highlights the magnitude of venture-backed activity shaping today’s global economy.

The Evolution of Venture Capital to the 108Bpost Era

Early Stages of Venture Capital

The concept of venture capital is not new. Decades ago, wealthy individuals and private firms began financing early-stage companies with high growth potential. Unlike traditional loans, VCs took equity stakes and shared risks alongside entrepreneurs.

The Tech Boom and Expansion

The late 20th century marked the rise of Silicon Valley, sparking a rapid expansion in venture capital. Iconic firms like Sequoia Capital, Andreessen Horowitz, and Benchmark became synonymous with unicorns—startups valued at over $1 billion.

Today’s Mega-Funding Rounds

We now live in an era where single funding rounds often exceed $500 million. Companies like Stripe, SpaceX, OpenAI, and ByteDance receive billions from VCs betting on disruptive innovation. The PitchBook VCs 108Bpost metric illustrates this dramatic scale-up, where combined post-investment valuations exceed $108 billion, marking a new high point in venture history.

Why $108 Billion Matters in Venture Capital

Symbol of Market Confidence

When investors commit over $108 billion, it reflects confidence in innovation-driven economies. Startups are no longer seen as risky experiments—they are essential to global competitiveness.

The Unicorn Surge

According to PitchBook data, more than 1,200 unicorns exist globally. Many of these unicorns are part of the 108Bpost funding ecosystem, with valuations fueled by mega-investments.

A Global Phenomenon

While Silicon Valley remains a leader, venture capital is now global. Across fintech hubs in London and Singapore to AI innovators in Tel Aviv and Bengaluru, the 108Bpost milestone highlights the global surge in startup funding.

Key Sectors Driving PitchBook VCs 108Bpost

1. Artificial Intelligence (AI) and Machine Learning

AI startups receive multi-billion-dollar backing as industries—from healthcare to finance—adopt intelligent automation. OpenAI, Anthropic, and Cohere are leading examples funded under this wave.

2. Fintech

Digital banking, blockchain, and crypto technologies attract major investments. Companies like Stripe, Revolut, and Coinbase are integral parts of this funding surge.

3. Healthcare and Biotech

The pandemic accelerated VC interest in healthcare innovation. From mRNA vaccines to biotech startups, billions are flowing into life sciences.

4. Climate Tech and Sustainability

Green energy, carbon capture, and sustainable manufacturing are attracting unprecedented venture support, reflecting global climate priorities.

5. Space Technology

Companies like SpaceX and Rocket Lab show how VC money is expanding frontiers beyond Earth.

The Post-Investment Dynamics of 108Bpost

When a startup secures VC funding, the journey doesn’t end—it transforms. The post-investment stage is where growth and scaling happen.

-

Scaling Operations – Startups use funds to expand production, hire talent, and globalize operations.

-

Market Penetration – Companies accelerate customer acquisition and brand recognition.

-

Strategic Partnerships – VCs connect startups with other portfolio companies, corporations, or government contracts.

-

Exit Strategies – The eventual goal is IPOs, acquisitions, or secondary market exits.

The PitchBook VCs 108Bpost spotlight focuses on how these massive investments translate into real-world economic power after funding is secured.

Challenges Facing the 108Bpost Ecosystem

Despite the impressive funding figures, challenges remain:

1. Overvaluation Risks

High post-money valuations sometimes overinflate startup worth, creating the risk of market corrections.

2. Economic Slowdowns

Recessions and interest rate hikes can reduce VC appetite, making startups vulnerable.

3. Intense Competition

With billions at stake, competition among startups and VC firms intensifies, sometimes leading to rushed decisions.

4. Regulatory Pressure

Governments are scrutinizing data privacy, crypto markets, and monopoly risks, which may affect startup growth.

Case Studies in PitchBook VCs 108Bpost

Stripe: The Fintech Giant

Backed by billions in VC funding, Stripe is a textbook example of how post-investment growth turns startups into global leaders. Valued at over $50 billion, it stands as a major contributor to the 108Bpost total.

OpenAI: AI Disruption at Scale

AI research company OpenAI, with backing from Microsoft and venture firms, has transformed into a global leader, redefining AI adoption.

SpaceX: Reaching Beyond Earth

SpaceX illustrates how VC investments not only impact industries but also shape humanity’s future ambitions.

The Future of Venture Capital in the 108Bpost Era

Democratization of Investment

With crowdfunding and decentralized finance, more individuals can participate in startup funding.

AI-Powered VC Decisions

Data-driven investment, powered by AI, will make future funding decisions faster and more precise.

Shift to Impact Investing

The next wave of 108Bpost funding may emphasize sustainability, inclusivity, and ethical innovation, not just profits.

Emerging Markets

Countries like India, Brazil, and Nigeria are becoming VC hotspots, contributing to future PitchBook reports.

Conclusion

The phrase PitchBook VCs 108Bpost is more than financial jargon—it symbolizes a new chapter in global venture capital. With over $108 billion funneled into startups across industries like AI, fintech, biotech, and sustainability, the VC ecosystem is reshaping the world economy.

While challenges like overvaluation and regulatory risks remain, the opportunities are vast. Startups funded under the 108Bpost umbrella are not only creating unicorns—they are building the future of technology, society, and even humanity’s next frontier in space.

As PitchBook continues to track this phenomenon, one thing is clear: venture capital in the 108Bpost era is no longer about betting on ideas—it’s about powering the engines of tomorrow’s world.